In this age every leading bank, brokerage, insurance company, credit card provider and financial services company already understands that creating a smooth digital customer experience is mission-critical to their overall success. And yet so many of them are still making basic mistakes when it comes down to optimizing digital customer experience for financial services.

Today’s customers expect round-the-clock access to their financial data – bank accounts, investments, credit card charges; the list goes on. Likewise, when a customer is in the market for a new provider or a new policy, they expect to be able to open an account or receive a preliminary quote in a matter of a few simple clicks. In fact, a recent Accenture Consulting report said that in banking “the internet is the dominant channel”, and found that 60 percent of bank customers use online banking at least weekly. So if you haven’t already upped the ante, now’s the time to get serious about customer experience in retail banking.

When it comes to millennials, providing a smooth digital customer experience is more crucial than ever. The same Accenture report found that 84% of these digital natives are happy to receive entirely computer-generated advice when they need to decide which bank account to open, and a Gallup report found that 73% of them actively prefer having a digital relationship with their bank. What’s important to note about this generation of consumers is that their loyalties are not as strong as those of their predecessors, with only 25% fully engaged as customers (i.e. that they’re emotionally and psychologically attached to a brand). This means that you need to keep them happy with top-notch digital customer experience. Millennials expect the banking industry to change to suit their needs and wants – to be accessible and easy. This by no means requires 100% digital services, in fact they “want human connection when they need it”, but it does mean simple, smart and personalized services.

At Contentsquare, we’ve helped countless global financial services providers – such as MetLife, The Royal Bank of Scotland, and Saxo Bank – to shed light on what they can be doing to improve financial services customer experience. Let’s take a look at two case studies that show how companies are transforming the customer experience management in banking and financial services, specifically at the account opening stage.

1. A credit card provider that was committed to providing prospective customers with all the information necessary to raise confidence included a prominent display of security policy details on the account opening page. However the company’s web team found lower than expected conversions for credit card applications. Through Contentsquare’s digital customer experience management services they could see that prospects weren’t engaging at all with the security content, and instead they were scrolling down the page to see the features chart. This pinpointing of the problematic area helped the company build several variations to test its hypothesis, and very quickly the digital team saw that removing the security content allowed visitors to find the content they were interested in much faster. After making the change, the company saw a 1.2% uplift in credit card sign-ups.

The kind of visual information we get from Contentsquare allows us to continually make more informed decisions. While the lift may not seem like a lot, it actually is rather significant for our volume, and it was good to know we could make the decision to remove the content panel without hurting our KPIs,” according to the company’s web insights manager.

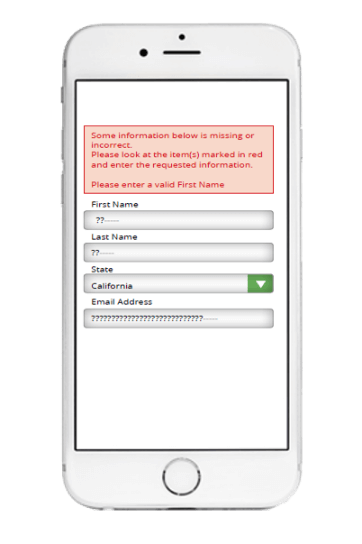

2. A leading retailer of financial services that targets consumers seeking alternatives to traditional banking relationships was looking to streamline the mobile banking customer experience for its website. Using Contentsquare, the team found that over 32% of potential customers were struggling with an error while filling in the mobile form.The users who encountered the error stayed on the form three times longer than other users, and unsurprisingly, many eventually abandoned the site. Contentsquare located the source the error, and once the company fixed the issue, loan applications via mobile increased by 14%, with a 10.2% increase in short-term loans and an 18.3% increase in installment loan products. In addition, by using the Time Report in Contentsquare’s form analytics, the company learned that visitors were able to complete the form five times faster than before.

After fixing the error, applications increased by 14% and form completion rates were five times faster.

Digital customer experience management is crucial at every step of the acquisition or conversion process, so that providers can closely watch and micro-optimize each step, ensuring a seamless ride for potential customers. Aside from the inherent monetary loss of each tenth of a percent of prospect dropoff, the acquisition funnel – the first substantial customer interaction with the institution – is where brand reputations are made or broken. So for long-term success, it’s crucial to provide top-notch customer service in financial services.

Clicktale was acquired by Contentsquare in 2019. Since then, tools and features mentioned in this blog may have evolved. Learn more about our Digital Experience Analytics Platform.